The Origins of the Perfect, Zero-Evasion, Zero-Corruption Tax system, Humanity, and the Era of Abundance

(and it isn’t Socialism)

Enter the Age of Abundance for Humanity, enabled by innovations in DeFi and blockchain/cryptocurrency.

TL; DR:

- Inequality is tearing the world apart, and we need to fix it before it is too late.

- Bitcoin is flawed as it does not fix wealth inequality and whale manipulation problem that leaves the average Joe behind

- Centralisation does not only plague Bitcoin and all current cryptocurrencies but the exchanges which process all transactional/trading volume

- Taxation from a centralised, non-blockchain government entity is inherently flawed, but blockchain and smart contracts and a DeFi protocol has fixed it.

- The plugging of holes in tax via DeFi protocols will enable every human to share in the wealth of a successful network/economy.

- The mantra in libertarian-leaning crypto community, espoused by Antony Antonopoulos for the past decade had been “What if nobody paid tax". It just got flipped to "what if perfectly everyone pays tax" and flipped again to “what if it’s redistributed directly to people instead of to a central government body?" This perfectly counters the worry of it being “socialism" which is a common but very unfortunate misconception.

The first known taxation took place in Ancient Egypt around 3000–2800 BC. Since then, the past 5000 years of humanity had always been plagued by leakage of tax — corruption and leeches, siphoned away into undeserving hands, draining away the potential of a collective “goodwill” system that could uplift everyone if only it wasn’t plagued by the imperfect nature of humans, a system so sophisticated that requires every single human to take a very specific, conscious action to pay a tax just would never achieve a 100% participation rate, unless by force or threat.

Fast forward to 2020, cryptocurrencies have started to enter the mainstream and blockchain, Bitcoin, Ethereum has made trustless banking accessible by millions. Absolute transparency of Finance has come true. Every transaction on the blockchain, visible by every human.

Trouble In Paradise — Growing Wealth Inequality, Centralisation

In the early stages of Bitcoin, people touted it to be a “revolution” that would be beneficial for humanity. What they didn’t mention is that while it addressed a problem, it did not really solve the most pressing problem of the 21st century.

Before Bitcoin could even fully complete it’s revolution of the financial world, early adopters have spotted a glaring fundamental problem in Bitcoin — Wealth Inequality. Rich people with millions in the bank always could buy massive whole numbers of Bitcoin while early adopters were hyping up owning just 1 Bitcoin being enough to retire the new blood buying at the top. The result? Centralisation of BTC ownership in the hands of the few. Where once the average Joe could spend a couple hundred dollars on a home computer to mine hundreds of Bitcoin , Hash-power spiralling out of control resulted in only massive corporations being able to stay in the game of mining bitcoin, with million dollar equipment required and giant industrial facilities set up with hundreds and thousands of commercial scale miners just to make mining Bitcoin a viable business.

Whale Manipulation worsening inequality

Inequality in cryptocurrency is getting worse with whales (very rich individuals) amassing more BTC due to having more resilience to a price dump and crash in prices, and continuously amass more in a bear market while retail investors sell away their little portion they have from the past 3 years after being shaken out by a brutal dip from the top of Bitcoin’s $20,000.

The average Joe has been more susceptible to emotional manipulation via whale tactics which trick them into falling victim to changing hands and giving up the scarce Cryptocurrency to wealthier, more cunning traders.

We need something revolutionary to blockchain to begin even taking a step to addressing this problem.

Centralisation, Inequality and the Tyranny of Centralised Exchanges

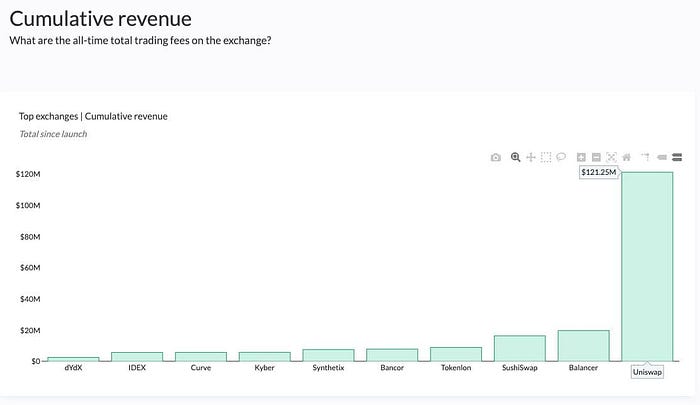

A quick example — Binance. Exchange customers have been increasingly pressured to use KYC (Know-Your-Customer), a highly criticized, and worrying trend among privacy rights advocates and the general crypto community. Yet, the public are coerced into doing so by being withheld from withdrawing their own funds if they do not submit their personal documents and information to the company.

On top of that, after bullying customers into giving up their personal information to be allowed access to their own funds, Binance is still reporting profits of $800 million to $1 billion this year, from the trading fees they are charging customers and pocketing for themselves.

Enter Reflect.Finance, the solution to these problems in the form of innovation in Decentralised Finance

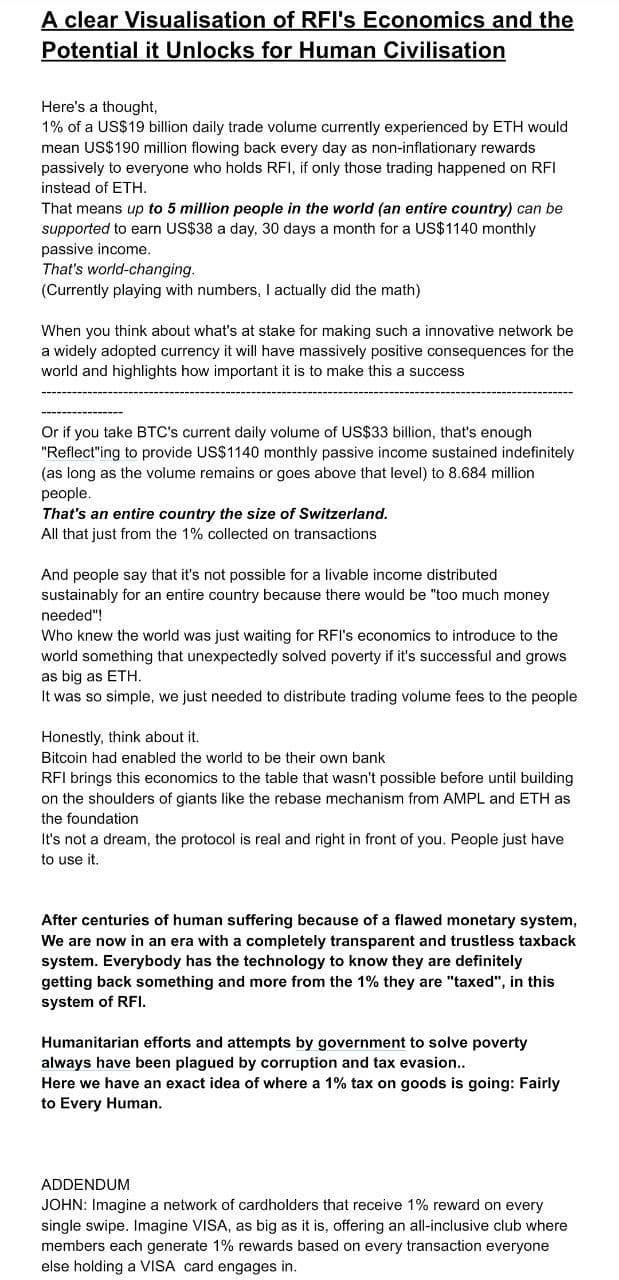

Meanwhile, a new development in DeFi has sparked an idea in the mind of a observer on the sidelines, that the solution to these problems could lie in it’s novel function — transferring a 1% fee from each transaction to EVERY holder of RFI, with the amount earned being weighted on how much of the supply you own, seamlessly, frictionlessly, gaslessly.

Thanks to this, the Centralised volume fees from the above example, that 1 $1 billion in profit could be flowing back to every holder if only they traded on RFI.

This function builds on top of the giants that came before like Ampleforth, which Rebase function seamlessly adds or substracts the number of tokens in your wallet, without requiring a transaction.

On top of that, the simple fact that the earned amount being weighted is GENIUS and I will explain why in three letters- UBI

I’ve been trying to avoid calling it RFI’s function a UBI because the rewards paid out from the fee on volume is weighted, fundamentally it is different from a Static UBI yet it still appeals to both libertarians who are against government taxes, and liberals who want taxes. It’s a way to unite both political spectums and spring humanity forward.

The idea of providing a Universal Basic Income (UBI) had been an idea since the 16th century, however prior to smart contracts it always depended on a Centralised, Government institution which is dangerous for obvious reasons. Thats the first big problem.

Second problem is,

Usually non-weighted UBI would turn off the super-rich because they are the ones being taxed the most in this kind of system.

However in RFI the richest in the system get a weighted portion which incentivises even the super-rich to dip in and participate in this network while the smallest wallet enjoys wealth from the billionaire participation that wouldn’t otherwise happen without that incentive. There had always been the chicken and egg problem on how to tempt billionaires into paying tax into a system because they get “no benefit” from it. This weighted form of return could be the “gateway drug” that enables even better possibilities down the road.

Exploitation of the System

The third problem of implementing UBI on a blockchain is, that if it was evenly distributed to every address, people could just create as many blockchain addresses as they want, reaping the income of a UBI payment meant for an extra citizen for each duplicate address the person creates. It’s a hard problem that isn’t likely to be solved for the next 10 years, until we figure out a way to tie Human Identity Verification to specific blockchain addresses to prevent exploitation. Even so, with RFI’s genius implementation of supercharged economics, that does not seem necessary anymore, at least for now.

The Solution to all 3 Problems

While people could try to game the system by creating as many wallet addresses as possible if it was distributed equally to every single wallet. However due to the weighted nature of ReFi (a new term coined by the community of this new technology), people are unable to game this system to collect more money by just creating more empty wallets. You have to hold a portion of RFI and buy into the network to join this prosperous collective money and in turn receive a proportionate amount of RFI. It’s un-gameable, un-exploitable. This is our bleeding edge technology, and the best and most friction-less way to go about it that we have right now.

It’s simply genius.

The solutions to all these centuries-long problems plaguing humanity alone, simply deserves the creator of RFI a Nobel prize.

It’s the best of both worlds and we could’ve cracked this puzzle on how to light this fire of participating in a perfect tax and progress humanity.

~On the implications of prosperity when RFI is adopted massively..

The result will be a age of prosperity where a liveable income can be supported for at least an entire country of population.

This is simply thanks to stamping out corruption and stopping the leakage of tax dollars away to undesirable exploiters, the tax evaders, the leeches that siphon billions of dollars of funds for their undeserving, corrupted personal gains for a few unethical individuals at the expense of everybody else. All of this is obsolete with RFI entering every human into a absolute, reliable, trustless, smart contract that erases all corruption. In short, Blockchain, rebase function, and subsequently the Reflect function has enabled this new era.

This sort of technology is what enables possibilities that Congress could never even dream to pull off in 100 years. Without the innovation of blockchain and rebase function - building on shoulders of giants which resulted in Reflect function, none of this would be possible.

When RFI takes off, millions will be financially free. They will enjoy their rights to 1% of the prosperity of a network/economy to share in that wealth in the form of frictionless earnings inflationless-ly.

When every human gets a stake in a potentially trillion dollar daily volume and can live off that income ;

And all that with full confidence that every single human pays their share into the tax that funds it without being able to exploit or escape it -— THAT, is the age of prosperity.